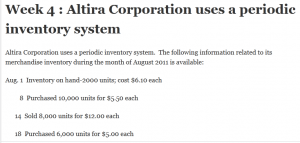

Week 4 : Altira Corporation uses a periodic inventory system

Account Homework Help

Altira Corporation uses a periodic inventory system. The following information related to its merchandise inventory during the month of August 2011 is available:

Aug. 1 Inventory on hand-2000 units; cost $6.10 each

8 Purchased 10,000 units for $5.50 each

14 Sold 8,000 units for $12.00 each

18 Purchased 6,000 units for $5.00 each

25 Sold 7,000 units for $11.00 each

31 Inventory on hand-3,000 units

Required:

Determine the inventory balance Altira would report in its August 31, 2011, balance sheet and the cost of goods sold it would report in its August 2011 income statement using each of the following cost flow methods:

1. FIFO

2. LIFO

3. Average cost

E8-14 Inventory cost flow methods: perpetual system

(This is a variation of exercise 8-13 modified to focus on the perpetual inventory system and alternative cost flow methods.)

Altira Corporation uses a perpetual inventory system. The following transactions affected its merchandise inventory during the month of August 2011:

Aug. 1 Inventory on hand-2000 units; cost $6.10 each

8 Purchased 10,000 units for $5.50 each

14 Sold 8,000 units for $12.00 each

18 Purchased 6,000 units for $5.00 each

25 Sold 7,000 units for $11.00 each

31 Inventory on hand-3,000 units

Required:

Determine the inventory balance Altira would report in its August 31, 2011, balance sheet and the cost of goods sold it would report in its August 2011 income statement using each of the following cost flow methods:

1. FIFO

2. LIFO

3. Average Cost

E8-18 Supplemental LIFO disclosures; LIFO reserve: Steelcase

Steelcase Inc. is the global leader in providing furniture for office environments. The company uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

5 Inventories ($ in millions):

February 27, 2009 February 29, 2008

Raw materials 61.3 67.5

Work-in-process 15.9 20.9

Finished goods 79.9 87.9

157.1 176.3

LIFO reserve (27.2) (29.6)

$129.9 $146.7

The company’s income statement reported cost of goods sold of 2,236.7 million fo the fiscal year ended February 27, 2009.

Required:

1. Steelcase adjusts the LIFO reserve at the end of its fiscal year. Prepare the February 27, 2009, adjusting entry to make the cost of goods sold adjustment.

2. If Steelcase had used FIFO to value its inventories, what would cost of goods sold have been for the 2009 fiscal year?

P 8-5 Various inventory costing methods

Ferris Company began 2011 with 6,000 unitsof its principal product. The cost of each unit is $8. Merchandise transactions for the month of January 2011 are as follows:

Purchases

Date of purchase Units Unit Cost* Total Cost

Jan. 10 5,000 $ 9 $ 45,000

Jan. 18 6,000 10 60,000

Totals 11,000 105,000

*Includes purchase price and cost of freight.

Sales

Date of Sale Units

Jan. 5 3,000

Jan. 12 2,000

Jan. 20 4,000

Total 9,000

8,000 units were on hand at the end of the month.

Required:

Calculate January’s ending inventory and cost of goods sold for the month using each of the following alternatives:

1. FIFO, periodic system

2. LIFO periodic system

3. LIFO, perpetual system

4. Average cost, periodic system

5. Average cost, perpetual system