Marketing Ethics: Product Safety And Pricing

1

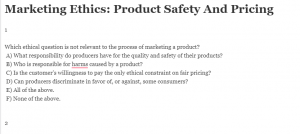

Which ethical question is not relevant to the process of marketing a product?

A) What responsibility do producers have for the quality and safety of their products?

B) Who is responsible for harms caused by a product?

C) Is the customer’s willingness to pay the only ethical constraint on fair pricing?

D) Can producers discriminate in favor of, or against, some consumers?

E) All of the above.

F) None of the above.

2

Identify the statement that fails to reinforce the idea that the purchases made by consumers may not be truly voluntary:

A) The more consumers need a product, the less free they are to choose.

B) The consumer may experience anxiety and stress, e.g., when purchasing an automobile.

C) Price-fixing and price-gouging may restrict the consumer’s freedom.

D) There may be marketing practices aimed at vulnerable populations such as children or the elderly.

E) All of the above.

F) None of the above.

3

Select the statement that represents a situation where informed consent is not operative:

A) The complexity of a product has been fully explained to a consumer.

B) The customer is not clear about the calculation of the interest rate on a leased product transaction.

C) The extended warranty conditions on a product have been fully disclosed to a consumer.

D) Warning labels on a product have pointed out any potential hazards associated with operating it.

E) All of the above.

F) None of the above.

4

Choose the statement that does not challenge the assumptions commonly found in economic textbooks that customers are benefited, almost by definition, whenever their preferences are satisfied in the market:

A) Impulse buying cannot be justified by appeal to consumer interests.

B) The exchange is prima facie ethically legitimate because it assumes that the individuals involved in the transaction act as free, autonomous agents capable of pursuing their own ends.

C) The ever-increasing number of bankruptcies suggests that consumers cannot purchase happiness.

D) Empirical studies provide evidence that greater consumption can lead to unhappiness.

5

Select the question that is most likely never relevant to the examination of business’ responsibility for its products:

A) What caused an event to happen?

B) Who is to blame for any harms caused, who is liable?

C) What was the agent’s motive?

D) Who was responsible for “caring for” a situation, accountable without any suggestion of culpability, fault, or blame?

6

The strict products liability standard requires a manufacturer to compensate injured consumers:

A) Only if it can be shown that the manufacturer was at fault in causing or failing to prevent a harm.

B) Even if the manufacturer was not at fault, even if there was nothing the manufacturer could have done to prevent the harm.

C) Only if the manufacturer used fraud or coercion at the time the contract for the product was agreed to by the consumer.

D) Only if the product’s features were described in a deceptive manner in advertising copy.

7

Select the statement that doesn’t challenge the claim that producers should not be held strictly liable for harms not caused by their negligence:

A) Strict liability adds significant hidden costs to every consumer product.

B) Strict liability places domestic producers at a competitive disadvantage with foreign businesses.

C) If it is unfair to penalize businesses for harms they couldn’t prevent, it is equally unfair to penalize consumers for harms they could not prevent.

D) Strict liability discourages product innovation and encourages frivolous and expensive lawsuits.

8

Identify the statements that George Brenkert claims represent justifications that juries use to hold manufacturers strictly liable but that are not fully convincing:

A) The consumer who is injured by a product is unfairly disadvantaged in the economic competition and is denied an equal opportunity to compete in the marketplace.

B) Manufacturers are best able to pay for the damages caused by their products.

C) Compensation returns the parties to equal standing and the economic competition can continue as a result.

D) Strict liability creates an added incentive for producing safe products.

E) Answers A and C are correct.

F) Answers B and D are correct.

9

It is alleged that markets fail, in some situations, to insure a fair price and thereby limit consumers’ freedom. Which statement does not support that allegation?

A) Sellers extract extraordinarily high prices in situations where consumers have few options for obtaining a needed product.

B) From the utilitarian perspective, consumers are always benefited by low prices and balancing the benefits to buyers from low prices with the benefits to sellers of high prices is the only ethical pricing issue.

C) Monopolistic pricing limits the variety of products available to consumers.

D) The more uniformity of prices one finds within an industry, the less likely it is that competition exists.

10

Select the statement that is at odds with the idea that pricing strategies may be unfair:

A) Large stores in competition with smaller stores can absorb losses from undercutting the smaller stores on price, an option not available to the smaller ones.

B) Distribution systems are established that reward large retailers with lower costs per unit than the cost per unit smaller stores must carry. As a result, the smaller ones may be driven from the market.

C) A competitive market should drive out uncompetitive firms by driving prices down.

D) Government subsidies of one industry may keep alternative industries from competing on price.