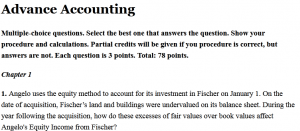

Advance Accounting

Multiple-choice questions. Select the best one that answers the question. Show your procedure and calculations. Partial credits will be given if you procedure is correct, but answers are not. Each question is 3 points. Total: 78 points.

Chapter 1

1. Angelo uses the equity method to account for its investment in Fischer on January 1. On the date of acquisition, Fischer’s land and buildings were undervalued on its balance sheet. During the year following the acquisition, how do these excesses of fair values over book values affect Angelo’s Equity Income from Fischer?

a. Building, Decrease; Land, No Effect

b. Building, Decrease; Land, Decrease

c. Building, Increase; Land, Increase

d. Building, Increase; Land, No Effect

2. On January 2, 2020, Campbell, Inc. purchased a 20% interest in Renner Corp. for $2,000,000 cash. During 2020, Renner’s net income was $2,500,000 and it paid dividends of $750,000.

Equity Investment balance should Campbell report at December 31, 2020?

a. $2,500,000

b. $ 500,000

c. $2,350,000

d. $2,150,000

3. On December 31, 2020, Park Inc. paid $500,000 for all of the common stock of Smith Corp. On that date, Smith had assets and liabilities with book values of $400,000 and $100,000; and fair values of $450,000 and $125,000, respectively.

What amount of goodwill will be reported on the December 31, 2020 balance sheet?

a. $ 50,000

b. $100,000

c. $200,000

d. $175,000

4. Francis, Inc. acquired 40% of Park’s voting stock on January 1, 2020 for $420,000. During 2020, Park earned $120,000 and paid dividends of $60,000. During 2021, Park earned $160,000 and paid dividends of $50,000 on April 1 and $40,000 on December 1. On July 1, 2021, Francis sold half of its stock in Park for $275,000 cash.

The Equity Investment balance at December 31, 2020 is:

a. $420,000

b. $444,000

c. $408,000

d. $492,000

5. On January 1, 2020, Cracker Co. purchased 40% of Dallas Corp.’s common stock at book value of net assets. The balance in Cracker’s Equity Investment account was $820,000 at December 31, 2020. Dallas reported net income of $500,000 for the year ended December 31, 2020, and paid dividends totaling $150,000 during 2020.

How much did Cracker pay for its 40% interest in Dallas?

a. $680,000

b. $500,000

c. $560,000

d. $760,000

Chapter 2

The following three Questions are based on the following set of facts.

Lucky’s Company acquires Waterview, Inc., by issuing 40,000 shares of $1 par common stock with a market price of $25 per share on the acquisition date and paying $125,000 cash. The assets and liabilities on Waterview’s balance sheet were valued at fair values except equipment that was undervalued by $300,000. There was also an unrecorded patent valued at $40,000, as well as an unrecorded trademark valued at $75,000. In addition, the agreement provided for additional consideration, valued at $60,000, if certain earnings targets were met.

The pre-acquisition balance sheets for the two companies at acquisition date are presented below.

| Lucky’s Company | Waterview, Inc. | |

| Cash | $300,000 | $260,000 |

| Accounts receivable | 250,000 | 135,000 |

| Inventory | 254,000 | 275,000 |

| Property, plant, and equipment | 2,300,000 | 356,500 |

| $3,104,000 | $1,026,500 | |

| Accounts payable | $45,000 | $37,500 |

| Salaries and taxes payable | 450,000 | 46,000 |

| Notes payable | 500,000 | 450,000 |

| Common stock | 250,000 | 60,000 |

| Additional paid-in capital | 950,000 | 106,500 |

| Retained earnings | 909,000 | 326,500 |

| $3,104,000 | $1,026,500 |

6. At what amount is the investment recorded on Lucky’s books?

a. $1,000,000

b. $1,100,000

c. $1,125,000

d. $1,185,000

7. Compute consolidated property, plant & equipment.

a. $2,600,000

b. $2,656,500

c. $2,956,500

d. $3,071,500

8. What is consolidated retained earnings?

a. $ 582,500

b. $ 909,000

c. $1,235,500

d. $2,195,500

The following two questions are based on the following set of facts.

On January 1, 2021, Consolidated Company purchased 100% of the common stock Avergy Industries for $720,000. On that date, Avergy had common stock of $100,000 and retained earnings of $420,000. Equipment and land were each undervalued by $50,000 on Avergy’s books. There was a $40,000 overvaluation of Bonds Payable, as well a $60,000 undervaluation of inventory

9. What is the amount of goodwill recorded in connection with this combination?

a. $0

b. $ 50,000

c. $ 80,000

d. $200,000

10. The consolidation entries necessary for a date of acquisition balance sheet include all of the following, except:

a. Land debit, $50,000

b. Inventory debit, $60,000

c. Bonds Payable credit, $40,000

d. Equipment debit, $50,000

Chapter 3

The following information applies to the following 3 Questions:

On January 1, 2020, Coldspring Corp. paid $770,000 to acquire Whitt Co. Coldspring used the equity method to account for the investment. The following information is available for the assets, liabilities, and stockholders’ equity accounts of Whitt:

| Book Value | Fair Value | |

| Current assets | $95,000 | $95,000 |

| Land | 95,000 | 120,000 |

| Building (twenty year life) | 255,000 | 310,000 |

| Equipment (five year life) | 185,000 | 190,000 |

| Current liabilities | 40,000 | 40,000 |

| Long-term liabilities | 65,000 | 65,000 |

| Common stock | 140,000 | |

| Additional paid-in capital | 300,000 | |

| Retained earnings | 210,000 |

Whitt earned net income for 2020 of $125,000 and paid dividends of $18,000 during the year.

11. What is the AAP amortization expense for 2020?

a. $3,750 Debit

b. $1,750 Debit

c. $3,750 Credit

d. $1,750 Credit

12. For 2020, what is the balance in Equity Income on Coldspring’s books?

a. $121,250

b. $125,000

c. $128,750

d. $143,000

13. What is the balance in Equity Investment at the end of 2020?

a. $873,250

b. $877,000

c. $891,250

d. $895,000

14. Cleaverland purchased 100% of Omaha on January 1, 2019 for $650,000. On that date, Omaha’s stockholders’ equity was $650,000, and the recognized book values of Ottowa’s individual net assets approximated their fair values. Omaha had net incomes of $150,000 and $190,000 for 2019 and 2020, respectively. The subsidiary paid dividends amounting to $30,000 in both years. Cleaverland uses the equity method to account for its pre-consolidation investment in Omaha.

What was the balance in Equity Investment at December 31, 2020?

a. $650,000

b. $710,000

c. $990,000

d. $930,000

Chapter 4

15. Brendon, Inc. acquired 100% of Weston Enterprises on January 2, 2020. During 2020, Brendon sold Weston for $700,000 goods which had cost $500,000. Weston still owned 40% of the goods at the end of the year. In 2021, Brendon sold goods with a cost of $500,000 to Weston for $700,000, and the buyer still owned 40% of the goods at year-end. For 2021, cost of goods sold was $1,000,000 for Brendon and $990,000 for Weston.

What was consolidated cost of goods sold for 2021?

a. $1,370,000

b. $1,290,000

c. $1,870,000

d. $1,990,000

Clearwater Co. owned all of the voting common stock of Kelley, Inc. On January 2, 2020 Clearwater sold equipment to Kelley for $350,000. The equipment had cost Clearwater $425,000. At the time of the sale, the balance in accumulated depreciation was $125,000. The equipment had a remaining useful life of eight years and no salvage value.

16. For the consolidated balance sheet at December 31, 2021, at would amount would the equipment (net) be included?

a. $225,000

b. $262,500

c. $306,250

d. $-0-

On April 1, 2020, Republic Company sold equipment to its wholly owned subsidiary, Barre Corporation, for $40,000. At the time of the transfer, the asset had an original cost (to Republic) of $60,000 and accumulated depreciation of $25,000. The equipment has a five year estimated remaining life.

Bare reported net income of $250,000, $270,000 and $310,000 in 2020, 2021, and 2022, respectively. Republic received dividends from Barre of $90,000, $105,000 and $120,000 for 2020, 2021, and 2022, respectively.

17. What was the amount of the gain or loss on the sale of equipment reported by Republic on its pre-consolidation income statement in 2020?

a. $-0-

b. $ 5,000 gain

c. $20,000 loss

d. $35,000 gain

18. What was the amount of the credit to depreciation expense on the 2021 consolidation worksheet?

a. $ 750

b. $-0-

c. $1,000

d. $1,600

Renne Company sold land to Bethany Enterprises, its parent, on June 1, 2020. The sale price was $218,000. The land originally cost Renner $239,000. Renner reported net income of $400,000 and $496,000 for 2020 and 2021, respectively. Bethany sold the land it purchased from Renner for $228,000 in 2022.

19. What is the consolidated amount of gain or loss on sale of land for 2022?

a. $10,000 gain

b. $10,000 loss

c. $11,000 loss

d. $21,000 loss

Chapter 5

The following information pertains to the following 2 Questions.

On January 1, 2021, Gooch Company acquires 80% of the outstanding common stock of House Inc., for a purchase price of $12,400,000. It was determined that the fair value of the noncontrolling interest in the subsidiary is $3,100,000. The book value of the House’s stockholders’ equity on the date of acquisition is $10,000,000 and its fair value of net assets is $11,000,000. The acquisition-date acquisition accounting premium (AAP) is allocated $600,000 to equipment with a remaining useful life of 10 years, and $250,000 to a patent with a remaining useful life of 5 years.

20. The [A] consolidating journal entry (on Gooch’s books) to recognize the acquisition date AAP and allocate the ownership interest in those assets to the parent and noncontrolling interests includes:

a. Equity investment, credit, $5,350,000

b. Noncontrolling interest, credit, $3,100,000

c. House’s retained earnings, debit, $2,00,000

d. Noncontrolling interest, credit, $1,070,000

21. What is the acquisition accounting premium (AAP)?

a. $5,500,000

b. $4,650,000

c. $2,400,000

d. $4,400,000