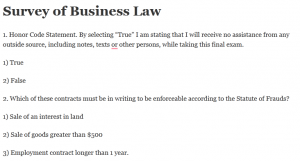

Survey of Business Law

1. Honor Code Statement. By selecting “True” I am stating that I will receive no assistance from any outside source, including notes, texts or other persons, while taking this final exam.

1) True

2) False

2. Which of these contracts must be in writing to be enforceable according to the Statute of Frauds?

1) Sale of an interest in land

2) Sale of goods greater than $500

3) Employment contract longer than 1 year.

4) All of the above

3. Under the UCC which of the following must be included in a confirming memo sent after conclusion of verbal negotiations in order to satisfy the Statute of Frauds requirement?

1) Price term

2) Delivery terms

4) All of the above

4. Merchant A and Merchant B are negotiating in good faith for the sales of widgets. Merchant B accepts the terms of Merchant A’s offer, but adds to the bottom of the form “interest rate at 2% for unpaid balance as usual.” Merchant A does not object. Under these facts and UCC 2-207:

1) A contract is formed on the original terms.

2) No contract is formed; they are still negotiating.

3) Contract is formed including the interest rate for unpaid balance.

4) No contract because B’s acceptance is not a mirror image of A’s offer.

5. Bob Cratchit, who has been an employee-at-will with the firm of Scrooge & Marley, was laid off on Christmas Eve after 24 years and within several months of his receiving his full pension. The employee manual that was in effect when Bob began his employee stated that seniority would be given great weight in any layoffs. The manual was changed during Bob’s last year of employment in order to delete mention of any seniority rights. The HR department told him upon discharge that his seniority was not figured in their decision. Under these facts, which of the types of contracts below is the best theory of recovery for his suit for breach of contract?

1) Express contract

2) Implied contract

3) Executory contract

4) Restitution contract

6. Plaintiff and Defendant entered into a written contract for the sale Defendant’s land, a sunny stretch of acreage judging by the pictures and verbal representations Defendant had made. Plaintiff felt glad to have made a deal for it, that is, until he discovered that most of the land was over a toxic waste site. What best describes the situation with respect to the enforcement of the contract given that the defendant misrepresented the land and possibly defrauded the plaintiff?

1) The contract is void from the beginning.

2) The contract is voidable if the Defendant wants out of the deal.

3) The UCC will not allow this contract to be enforced.

4) The contract is voidable at the sole discretion of the Plaintiff.

7. Farmer A leased over 5,000 acres of farm land in northern Ohio for one year. Subsequently he signed a second 1 year lease. During each year he harvested the crops and prepared the land for the next season’s crops. During negotiations for the next lease, he began preparation of the land for planting, as was the local custom. Unfortunately Farmer A and his land lord couldn’t come to terms and the third year’s lease was never signed. Under these facts, what is A’s best theory of recovery of the value of the land preparations he made?

1) A should sue for breach of contract to recover his lost profits for the crops he didn’t get to plant.

2) A should sue in quasi-contract to recovery the value of the work he did in preparing the land for planting in the third year.

3) A has no remedy in contract law because he should have been more careful about working the land before he had a binding contract.

4) A should sue for promissory estoppel because he was relying on the third year’s lease to make his living.

8. Merchant A offers in writing to sell your company certain goods at a certain price and also promises in writing to keep the offer open until June 1. You are considering your options but have not accepted yet as it is still before June 1. Merchant A realizes that he can get a better price by selling the same goods to another company; therefore he sends you a revocation letter informing you the deal is off. He then sends a letter to Merchant C offering to keep his offer to sell at higher price open until June 15 What best describes the legal obligations of Merchant A in this fact pattern?

1) Merchant A can revoke his original offer because you have not accepted.

2) Merchant A can revoke his original offer because you have not paid any consideration to create an option contract to keep his offer open until June 1.

3) Merchant A is still obligated to hold his offer open you as required by the UCC.

4) Merchant A has formed a valid option contract with Merchant C.

9. Brodsky is interested in buying Culbertson’s land. He asks him to hold the land open and not sell to anyone else but him. They sign the following agreement: “In consideration of Culbertson’s promise to not sell to anyone else during the next 30 days, Brodsky will deposit a personal check in an escrow account at his bank, Lone Star Bank, which will be returned to him at the end of 30 days.” Under these facts, which statement is most accurate?

1) A valid option contract is formed.

2) Brodsky must buy the land at the end of the 30 days.

3) Culbertson is obligated to not sell to anyone else during the next 30 days.

4) Brodsky’s promise is illusory; there is no consideration for his side of the bargain.

10. Blue Chip, Inc. has agreed in writing to sell 100,000 of its programmable chips to Mr. Chips, Inc. for $10,000, to be delivered November 9th. Blue Chip has suffered a loss of skilled workers due to a strike and as a result its production capacity is greatly reduced. Wishing to stay on good terms with it customer, Blue Chip immediately informs Mr. Chips of the slowdown. Mr. Chips reluctantly agrees in writing to accept the chips on November 22. Under these facts and under the UCC:

1) This written modification of contract governed by the UCC needs no new consideration to be binding.

2) Mr. Chips can change its mind and immediately demand the chips because Blue Chip is under a preexisting duty to deliver on November 9.

3) Both A and B

4) Mr. Chips can still sue for breach of contract if the chips are not there on November 9th because there was no consideration for its promise to accept a later delivery time.

11. Hard Times Mining Cooperative of West Virginia has agreed in writing with the Peabody Coal Company to sell its entire production for the next three years, with the price to be indexed to coal production standards in the vicinity. Under these facts and the UCC :

1) Price terms are not definite enough; therefore, no contract is formed.

2) Valid output contract is formed.

3) Quantity is not certain; therefore no contract.

4) Valid requirements contract if formed.

12. Which of these promises would be enforceable as supported by valid consideration?

1) Your promise not to break any state or federal laws before you are 30.

2) My promise to give you an A on the final in consideration of your past hard work.

3) Your rich aunt’s promise to change her will and leave you a fortune.

4) Your promise to pay money in exchange for a promise to provide goods.

13. Mega Manufacturing has agreed over the phone to manufacture 10,000 highly specialized routers and couplers to the exact specifications required by Circuits Systems, Inc. for use in one of its proprietary designs. These are highly specialized goods for which there is no ready market. Mega sends a signed confirming memorandum “This is to confirm our understanding of the purchase of routers and couplers to be delivered to your Dayton, Ohio facility by Dec. 1, for a total contract price of $37,000.” Mega waits 10 days, then begins the manufacturing of the items and is nearly complete when Circuit Systems attempts to breach the contract. Under these facts and under the UCC:

1) Mega’s memorandum to Circuit is sufficient to satisfy the requirements of the statute of frauds.

2) Unfortunately this oral contract is not enforceable.

3) Mega’s verbal contract with Circuit is enforceable as a specialized goods exception to the Statute of Frauds rule.

4) Circuit is not bound to pay Mega for any of the goods because the confirming memo did not specify the quantity of goods.

14. You have entered into a valid binding bilateral contract to buy a painting in a private collection by the famous Dutch painter, Vermeer, for 11 million dollars. It is a rare item and a rare price. Before you can take possession, the seller tells you that he is refusing to honor the contract because he has a much, much better offer from the Tate Gallery in London. The breach of contract remedy that will allow you to obtain the painting itself rather than any monetary damages is:

1) Specific Performance

2) Consequential Damages

3) Punitive Damages

4) Compensatory Damages

15. Lucy Van Pelt is a pumpkin merchant and retailer. She has entered into a valid binding contract with Linus Wholesaling for the purchase of 1,000 giant pumpkins to be delivered Oct 1st at a per pumpkin price of $10. Linus is well aware of Lucy’s need for these particularly plump pumpkins during this specific selling season. Moreover, Lucy told Linus at the time they entered into the contract that she has specific resale deals that she must meet on time. Linus has figured his price based upon all the information Lucy has provided.

Subsequently, Linus fails to deliver all of these prize gourds on time, before Halloween. Therefore, Lucy was forced to buy as many replacement pumpkins as she could find on the open market for $15 in an attempt to meet her contractual obligations under her resale contracts. She couldn’t find enough substitute pumpkins and lost significant sales as a result. Assume that her lost profits are calculable at $12,000. Assume further that the rule in Hadley v. Baxandale

applies.

Generally under these facts which of the following statements is true only as to Lucy’s consequential

damages.

A) Lucy can recover the amount she spent to buy replacement pumpkins, $5 per pumpkin

B) Lucy should recover $12,000.

C) Lucy will not be allowed to recover consequential damages because Linus’ breach was not foreseeable from her perspective.

D) Lucy should recover @12,000 but only as incidental damages.

16. Pat promises Matt that he will buy his land for $100,000. Matt agrees wholeheartedly. They shake hands and agree to meet the next day to complete the transaction. Pat brings the agreed upon sum; Matt gives Pat a valid deed to the land.

Subsequently Pat suffers buyer’s remorse and wants his money back. What best describes his legal situation with respect to the Statute of Frauds?

1) Pat can get his money back because there was no written contract as required by the Statute of Frauds.

2) Pat can get his money back because the terms of the deal were not clear enough.

3) Pat cannot get his money back because the contract is still executory.

4) Pat cannot get his money back because the contract has been fully performed and it doesn’t matter that the contract was verbal.

17. Your company, the Dunder Mifflin Paper Company, has a valid contract to sell $100,000 worth of goods to one of its key customers. At the last minute the customer breaches. You’ve had to scramble to resell the same goods for $90,000 to meet your sales quota for the year. Which statement(s) below is/are correct as to what guidance the UCC offers in measuring Dunder Mifflin’s damages should they decide to sue for breach of contract?

1) Dunder Mifflin’s compensatory damages will be difference between the original contract price ($100K) and the price obtained on the open market ($90K)

2) Dunder Mifflin can always recover consequential damages.

3) Dunder Mifflin will be allowed incidental damages only if there are lost profits.

4) All of the above.

18. Stephen T. Colbert is under contract to speak at WSU graduation. On the day before he is to appear he tells the president, who signed the deal, that he cannot appear unless the university pays him $10,000 more than originally stated under contract. President Hopkins reluctantly agrees, but wisely bargains to get Colbert to agree to also give a lecture at the Raj Soin College of Business. Is the president’s agreement to pay extra money enforceable?

1) No because Stephen is under a pre-existing duty to perform and there is no valid new consideration.

2) Yes because Stephen has agreed to additional work, which is valid consideration for the common law contract modification.

3) No because that amount is too high and a court would never enforce such a ridiculous sum.

4) Yes because Stephen is worth it. (Not an answer)

19. Your Manufacturing Company receives a call from a long-time Client telling you to begin work ASAP on 1,000 widgets at $500 per unit to be made to the Client’s highly unusual specifications. You buy raw materials and immediately begin the manufacturing process. Because of the Client’s specifications, these widgets have no ready market. Subsequently, Client calls and says “Sorry, we changed our mind…oh, and don’t bother suing for breach of contract we only had a verbal agreement. There is no contract you can enforce.” What best describes the legal obligations in this fact pattern?

1) The Statute of Frauds requires contracts for the sale of good greater than $500 must be in writing to be enforceable; therefore, the Manufacturing Company is out of luck.

2) An exception to the Statute of Frauds allows Manufacturing Company to enforce the verbal contract only is there had been a confirming memo.

3) An exception to the Statute of Frauds allows Manufacturing Company to enforce the verbal contract because they are specially manufactured goods and work has already begun.

4) An exception to the Statute of Frauds allows Manufacturing Company to enforce the verbal contract irrespective of whether it had begun work on the order because they are specially manufactured goods.

20. X offers in writing to sell his land to Y and further promises (in writing) to keep this offer open until the end of this quarter so that Y will have time to think it over. X realizes that he really doesn’t want to sell the land at this time after all, and sends a letter to Y before the quarter telling him the deal is off. What best describes the legal obligations in this fact pattern?

1) The Statute of Frauds requires contracts for the sale of land to be in writing, therefore a contract has been formed and X must sell Y his land.

2) Because this transaction is governed by Common Law, X is allowed to revoke his promises before they are accepted.

3) Because X’s offers are written, Y is obligated to buy the property at the end of the quarter.

4) Y can force X to keep his promise open until he has time to think it over.