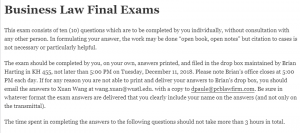

Business Law Final Exams

This exam consists of ten (10) questions which are to be completed by you individually, without consultation with any other person. In formulating your answer, the work may be done “open book, open notes” but citation to cases is not necessary or particularly helpful.

The exam should be completed by you, on your own, answers printed, and filed in the drop box maintained by Brian Harting in KH 455, not later than 5:00 PM on Tuesday, December 11, 2018. Please note Brian’s office closes at 5:00 PM each day. If for any reason you are not able to print and deliver your answers to Brian’s drop box, you should email the answers to Xuan Wang at wang.xuan@wustl.edu. with a copy to dpaule@pcblawfirm.com. Be sure in whatever format the exam answers are delivered that you clearly include your name on the answers (and not only on the transmittal).

The time spent in completing the answers to the following questions should not take more than 3 hours in total.

The ten (10) questions will have a total weight of 60 points allocated as follows:

Questions 1 – 8 5 points each

Questions 9 and 10 10 points each

1. You and two business associates have agreed to go into business together and are going to cause a separate entity to be created through which that business activity will be conducted. The three of you will actively participate in the development of the business. You anticipate that there may be losses incurred in the initial start-up year and, after that, you expect the business to be profitable. It is your intention to reinvest most of the earnings in the business and, at some point a number of years in the future, plan to sell the business.

As a result of the Tax Cuts and Jobs Act that became effective January 1, 2018, what are the two most likely forms of business entity that you would utilize and, of those two, which would be most appropriate for you and your two business associates?

2. You have decided to begin a management consulting business in which you will be the sole owner and initially, the only person performing services.

You have been advised that if you conduct your business activity though a corporation or an LLC, there may be some opportunity to obtain “limits on liability”. Please explain how that would apply to you individually if your management consulting business is conducted through a separate legal entity.

3. You are responsible for the organization of a pass-through business entity which will be owned by 15 different owners. You have considered the formation of a limited liability company and also a corporation which you would intend to elect S Corp status for tax purposes.

What are the limitations on the use of an S Corp that you should consider, and the reasons why you might find the limited liability company to be more advantageous?

4. You are the personnel director of a major business entity and have been asked to assist in the recruitment and hiring of a new employee who will fill a new position in the marketing department. The Marketing Director has prepared a job description which outlines the duties and responsibilities of this position and which description includes as requirements that all candidates must be a graduate of an Ivy League College, must be between the ages of 25 and 35, and must satisfactorily pass a personality test before being considered for a new position.

Please discuss these requirements and whether they present any issues to you in proceeding with the recruitment and selection of an appropriate candidate. How should this be handled by you to assure compliance with all employment laws?

5. During the years prior to the passage of the Civil Rights Act of 1964, Duke Power openly discriminated against African-Americans by allowing them to work only in the labor department of the plant’s five departments. The highest paying job in the labor department paid less than the lowest paying jobs in the other four “operating” departments in which only whites were employed. In 1955, the company began requiring a high school education for initial assignment to any department except labor. However, when Duke Power stopped restricting African-Americans to the labor department in 1965, it made completion of high school a prerequisite to transfer from labor to any other department. White employees hired before the high school education requirement was adopted continued to perform satisfactorily and to achieve promotions in the “operating” departments.

In 1965, the company also began requiring new employees in the departments other than labor to register satisfactory scores on two professionally prepared aptitude tests, in addition to having a high school education. In September 1965, Duke Power began to permit employees to qualify for transfer to another department from labor by passing two tests, neither of which was directed or intended to measure the ability to learn to perform a particular job or category of jobs. Griggs brought suit against Duke Power, claiming that the high school education and testing requirements were discriminatory and therefore prohibited by the Civil Rights Act of 1964. Is Griggs correct? Why?

6. In the reported case of Kurt D. Ellison vs. O’Reilly Automotive Stores, Inc., the trial court awarded $200,000 in compensatory damages and $2M in punitive damages. That award was affirmed on appeal. What were the actions by O’Reilly Automotive Stores, Inc. that caused a punitive damage award of $2M and the analysis by the court that supported that award?

7. A debtor went through bankruptcy under Chapter 7 and in that bankruptcy proceeding claims certain exempt property, does it make any difference in which state the debtor resides at the time of filing of the Chapter 7 proceeding in determining the exempt property to be granted to the debtor? Explain.

8. Until the case of Brookfield Communications v. West Coast Entertainment only “source confusion” would support a finding of trademark infringement. Brook field introduced a new concept that has been found by several courts to support copyright infringement in the context of the Internet. Identity that concept and described how it differs from source confusion.

9. You have been operating a very profitable consulting business in which you have offered consulting services to the public. Your clients are individuals and business entities of all types. You have not in the past had any other employees and have conducted your business as a proprietorship.

You have decided to expand your business by hiring Joe Hotshot, who will work for you as an employee and also offer consulting services to your clients.

On his first sales call to a new client, Joe advises the client that your company will provide information technology consulting services and at the request of the client, includes in the proposal which he submits to the client that your company will guarantee the results and will continue to perform additional services beyond the number of hours specified in the proposal, without any limit, until the client is satisfied. With those provisions included in the proposal, the client accepts the proposal and commits to purchase the consulting services for a fixed fee of $725,000.

Joe is so pleased with his first sale that he stops in a bar to celebrate his success, before coming back to the office to give the client accepted proposal to you. After several celebratory drinks, Joe leaves the bar and is on his way to the office when he negligently runs over Mary Oldgal as she is crossing the street at an intersection. Mary is severely injured as a result of Joe’s negligence.

a. Are you obligated to perform the consulting service contract that Joe entered into on your behalf, including the commitment to continue to perform services under the guarantee until the client is satisfied?

b. Would it make any difference if you had expressly instructed Joe Hotshot that he had no authority to enter into contracts on your company’s behalf if the dollar amount exceeded $50,000?

c. Are you liable for the injuries to Mary Oldgal?

d. What difference would your answer be to a, and c, if prior to hiring Joe, you had incorporated your consulting practice?

10. You are CEO of Successful Software, Inc. (“Successful”), a large publicly held corporation that is engaged in the software development business. Successful has been very financially successful and is looking to grow and expand. It desires to acquire Target Software Writers, Inc. (“Target”), a corporation that is closely held. There are three shareholders of Target, Michael Wewanta, William Our, Jack Money.

Target has few tangible assets located at a facility in Tennessee including office furniture fixtures and equipment, computers, and other tangible items have a relatively nominal value. Target employs 53 people engaged in its software development business and has also utilized the services of a number of outside independent contractors to develop its software products. In addition to the tangible assets, there are substantial intangible assets including intellectual property, licensing agreements, contracts and substantial goodwill. You have been in negotiations with Wewanta, Our and Money and they have decided to sell the business of Target to Successful. You and Wewanta, Our and Money have agreed that a total purchase price of $50,000,000 will be paid for this acquisition. It is intended that WeWanta, Our and Money will receive the $50,000,000 in cash and will not be shareholders of Successful or any surviving entity following the closing of the acquisition. It is anticipated that the definitive agreement will contain substantial warranties, representations, and indemnifications made by Wewanta, Our and Money with respect to the business of Target. Please discuss the way in which the risk for unknown liabilities can be addressed in this definitive agreement and the ways in which the parties can identify parameters or otherwise limit the risk allocation between Successful and Wewanta, Our and Money